This video is about the Advantages Retirement Plan mobile app, which allows you to access your retirement plan anywhere, anytime.

The video shows a user engaging with the app. On screen, a mobile phone displays the app, which says, “Hi Ben, your account total is $91,345.56 -> Earnings $11,345.56.” The app allows you to see your account balance and retirement forecast, and the screen shows the text: “Based on your current account value and your recurring contributions, you are projected to retire with an annual income of $100,000 at age 65. This is 80 per cent of your target retirement income of $125,000.” The video also shows the app button to view income breakdown, and the navigation bar of Plan, Accounts, Add funds, More. When the View income breakdown button is clicked, the app screen says, “$100,000 projected income” with a “How is this calculated?” tool tip.

The app shows you how much you can expect in retirement with a breakdown of how much you can expect – estimating how much you’ll receive from this plan, your savings outside of this plan, and your government benefits.

You can view the details of how much you’re saving from your bank account on the app. In the video, the mobile app screen shows contributions, monthly contributions, amounts, and percentage of income. It also displays your transactions and upcoming transactions.

When you click on the monthly contribution button, the app shows you the amount and percentage of income, along with a “How do I edit my contribution amount?” tool tip. The app will also show users a contribution breakdown, including where the funds are sourced from and where they are deposited.

The app allows users to track all of their transactions and check their investment performance. Users can see how their investment earnings have changed over time.

The app will display a breakdown of all of a user’s accounts, including RRSPs and TFSAs. Users can see how their investments adjust over time, as their diversified portfolio automatically rebalances and adjusts as they near retirement. The app has a slider tool, which can be used to see how funds will change over time.

The app also allows users to boost their savings by adding funds through a one-time contribution or by transferring in another TFSA, RRSP or RRIF.

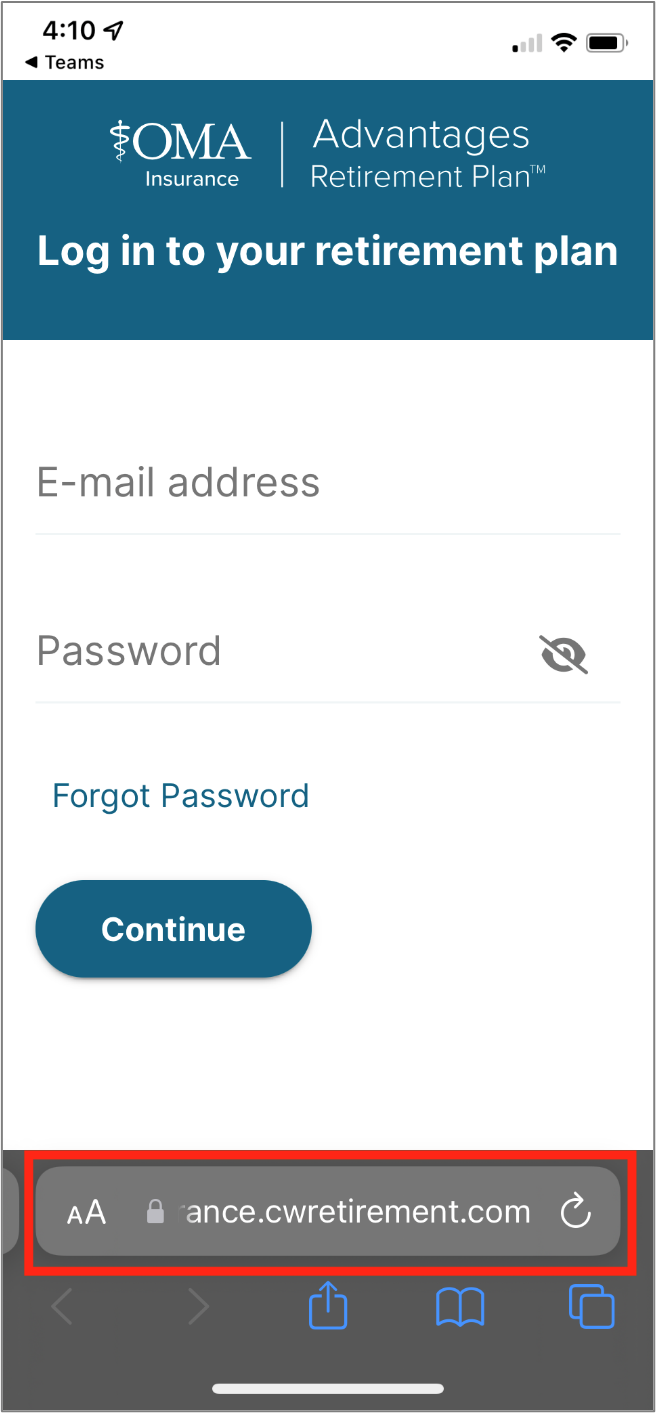

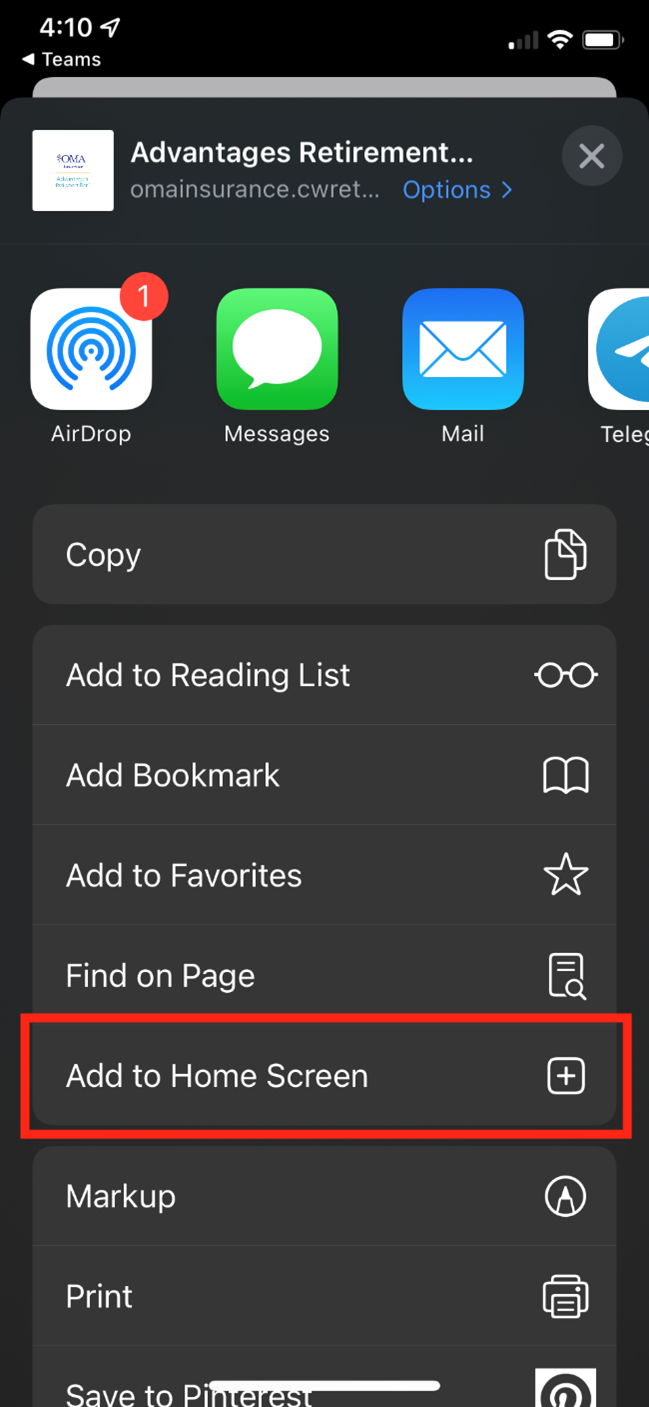

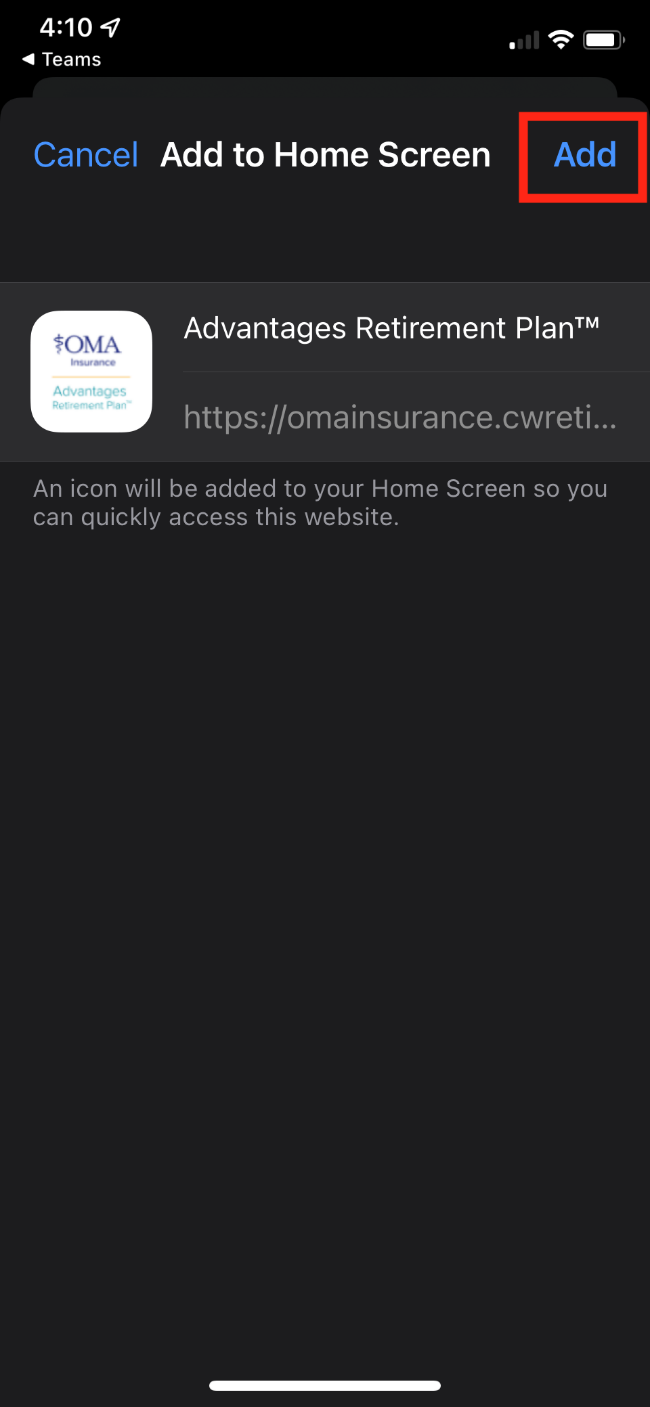

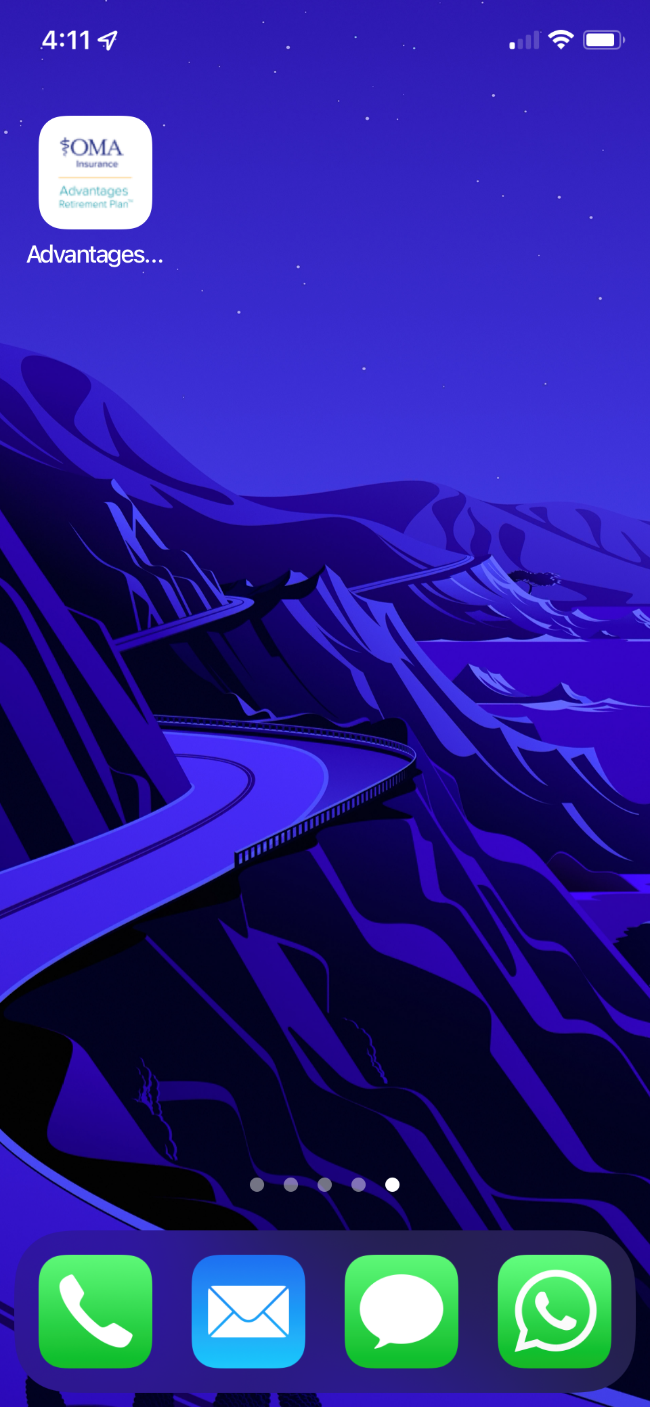

To access the app, log in to your plan on your mobile browser at omainsurance.cwretirement.com/sign-in.