Make Guaranteed Lifetime Income (GLI) part of your retirement plan. As an OMA member, you can enjoy the peace of mind that comes with an annuity – an income stream payable for life. OMA Insurance has selected Brookfield Annuity Company, the only insurance company in Canada focused exclusively on annuity products, to offer OMA members an opportunity to enhance their financial security in retirement.

Receive a defined amount of income for as long as you live

A lifelong source of retirement income for you

GLI payments are protected against market volatility and downturns

GLI is available through the OMA Advantages Retirement Plan™.

Does retirement planning concern you?

GLI is a guaranteed source of income that can play an important role in your long-term financial planning.

Are you worried about outliving your savings?

GLI provides an income stream that is payable for life.

Are you worried about protecting your investments from market downturns?

GLI payments are not impacted by market volatility. The amount of your GLI payment is guaranteed for life.

Do you want to offer financial security to your spouse?

You may elect to provide spousal payments after you pass away as part of GLI.

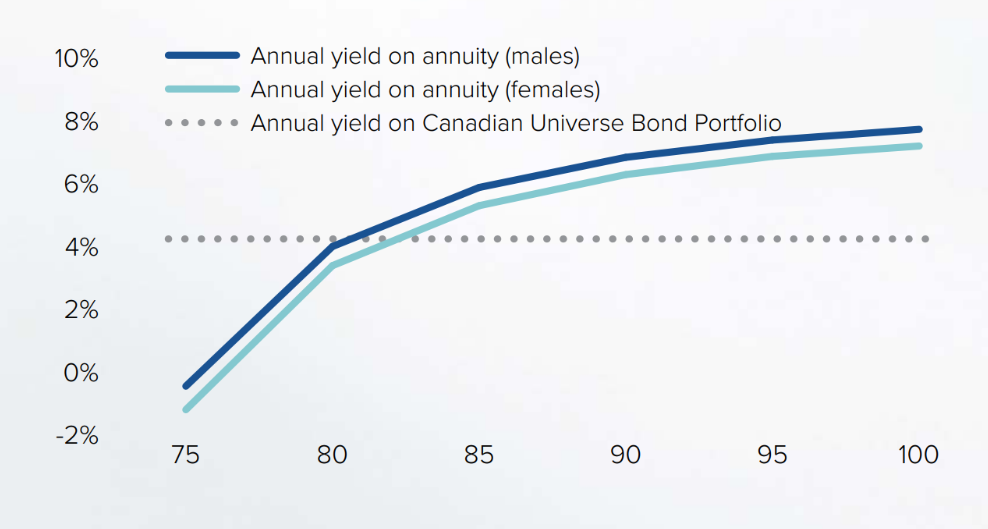

When compared to similar low-risk investments like investment-grade bonds, GLI delivers better long-term performance and provides the certainty that comes with guaranteed monthly payments for life.

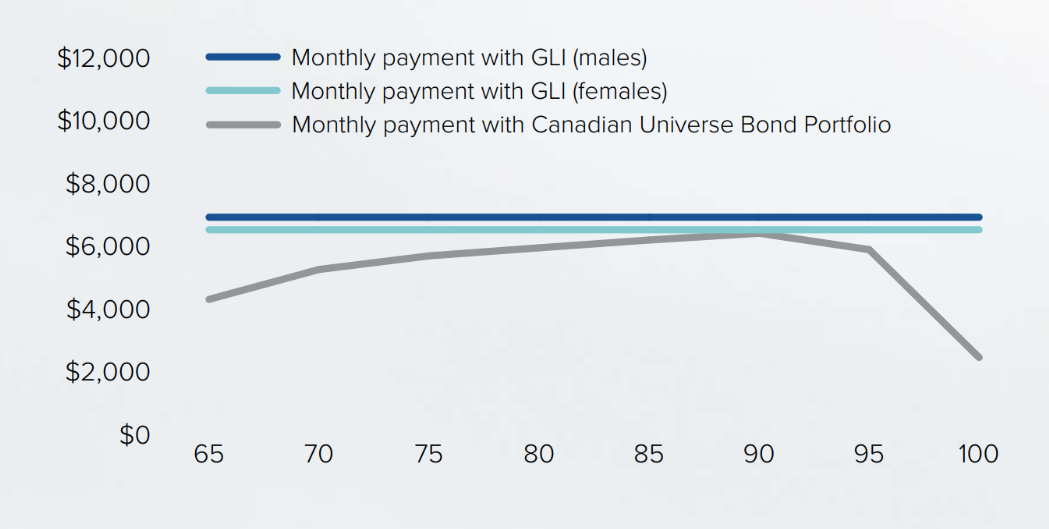

Monthly payout assuming $100,000 invested or used to purchase GLI at age 65

GLI delivers a dependable stream of income throughout your retirement years.

Break-even bond investment rate based on age of death*

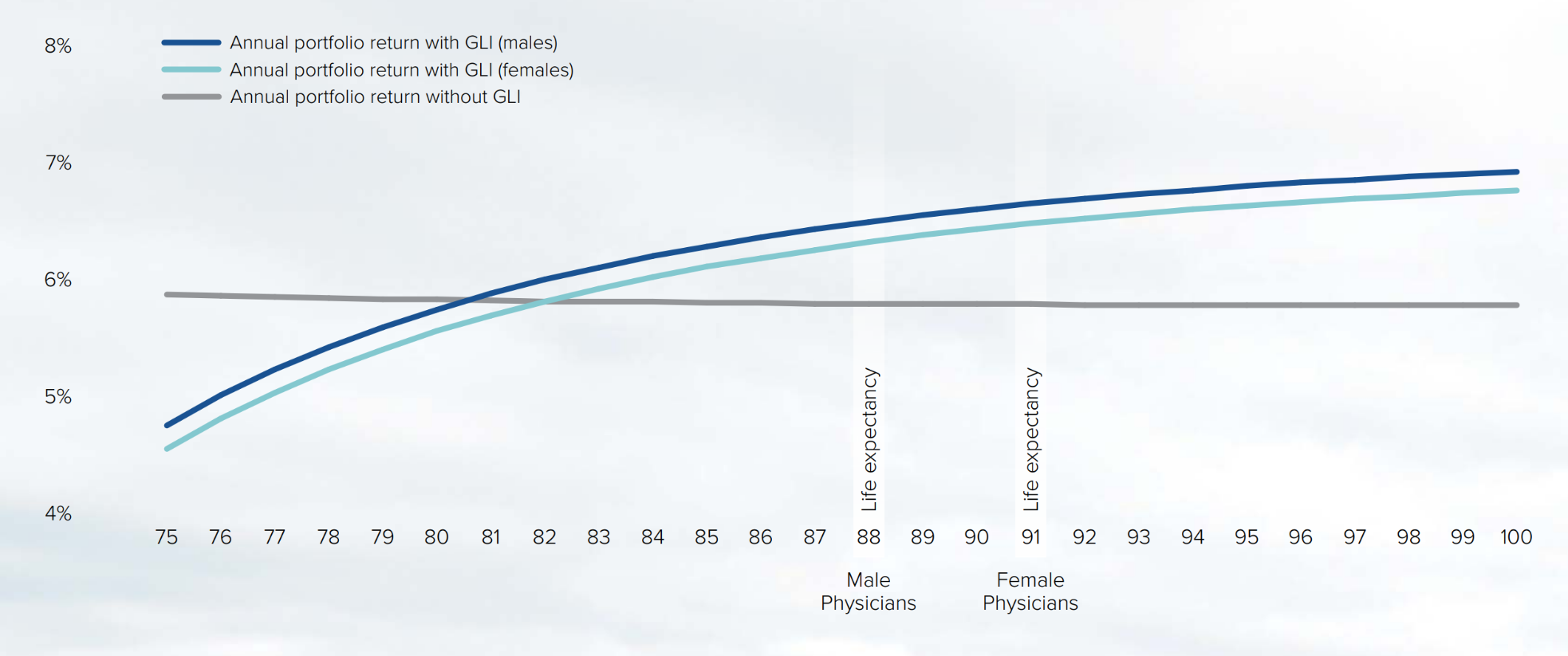

Assuming typical life expectancy, annuities would offer an annual return of approximately 6.3%, which is over 2% higher than the expected annual return of a diversified bond portfolio.

Return analysis based on age at death*†

GLI annuitants who live beyond age 80 (males) or 83 (females) will enjoy a higher rate of return than if they had invested in bonds.

* Returns are based on forward-looking assumptions and current RIF minimum withdrawal rates. Return expectations, annuity pricing, withdrawal rates and legislated minimums as of August 31, 2024. Past performance does not predict or guarantee future results.

† Assumes $10,000 invested annually from age 50 until age 65 according to the asset mix recommended by the BlackRock target date funds based on the member’s age. Investment in GLI is allocated in lieu of an allocation to Universe Bonds.

Brookfield Annuity Company, rated A- (Excellent) by A.M. Best, is the only insurance company in Canada focused exclusively on annuity products.

In Canada, annuities are available from highly regulated life insurance companies, which are required to hold the capital needed to pay the annuity payments under the policies issued.

Brookfield Annuity Company is a member in good standing of Assuris, which guarantees policyholder benefits to the greater of $5,000 per month and 90% of the monthly amount payable in the unlikely event of an insurer’s failure.

For support on the GLI product, please contact OMA Insurance at info@omainsurance.com or 1-800-268-7215 (option 3).

Talk to an OMA Insurance Advantages Retirement Plan™ Specialist to understand if GLI is right for you. GLI may not be right for you if you have a known shortened life expectancy. If you have other guaranteed forms of retirement income, please consider whether GLI is appropriate for your retirement portfolio. Individuals who can tolerate market volatility should determine whether GLI is appropriate for their risk tolerance. GLI is not suitable for individuals who wish to make a one-time bequest upon their death. Once GLI is purchased, the purchase cannot be refunded or otherwise reversed. GLI is not suitable for individuals who require liquid investments in their retirement. Please make sure this product is right for you prior to making any GLI purchases.

The brochure is not intended to provide a personalized recommendation of GLI to any individual. Information provided in this brochure should not be considered financial, tax planning, retirement or legal advice. Both OMA Insurance and Brookfield Annuity Company reserve the right to amend the GLI and/or discontinue the GLI offering for future purchases at their discretion. All information provided in this brochure is subject to the terms and conditions of the OMAI Individual Annuity Policy, underwritten by Brookfield Annuity Company, and to the receipt of an OMAI Individual Annuity Policy Application by Brookfield Annuity Company.